The Bottom Line.

In this Asia-Pacific Insight, Divay Pranav – Invest India Sr Assistant Vice President – explores the impact of China-US relations on the Indian economy. The trade war is already beginning to impact the Chinese economy and has forced the Chinese government to expedite structural reforms – writes. Interestingly, somebody’s loss is also someone else’s gain hence India now has an opportunity to develop economic leadership in the ASEA region, alongside with Vietnam and a couple of additional Southeast Asian countries.

Would you like more business trends and tips from regional Asia-Pacific experts? Read our latest Asia-Pacific Insights!

US-China Trade War: India’s ASEAN opportunity.

[By Divay Pranav]

China-US relations have monopolized a lot of attention over the past months, and that might give India a chance to rise and shine on the ASEAN scene.

The US has imposed three rounds of tariff on Chinese goods worth US$250 billion in the last 12 months. The duties up to 25% cover a wide range of goods including Chemicals, Agri-commodities, Machinery, Furniture and Automobiles, etc. Another round of tariff hike may cover remaining US$300 billion of imports impacting products such as apparels, footwear, toys, computers, smartphones, other electronic items, etc.

China has retaliated by imposing a tariff of 5% to 25% on US$110 billion of US products, including Chemicals, Coal and Medical Equipment.

China exported US$539.7 billion of goods to the US in 2018. Roughly one-third could be moved quickly to a third country. Furniture, shoes, garments and toys, for example, are products always in search of the lowest-cost country. They have experienced cost pressure for a decade in China because of increasing wages and tightening environmental standards.

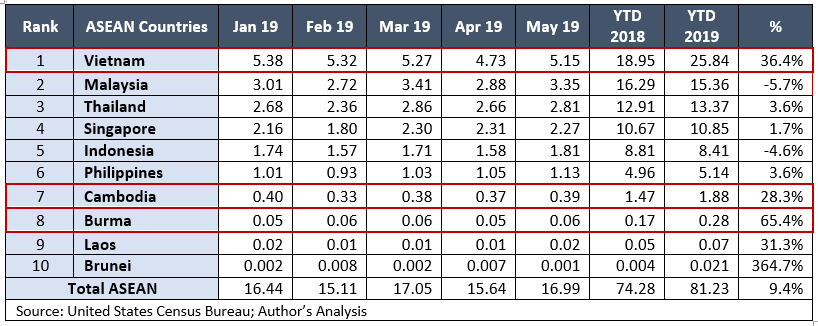

During the first five months of 2019 (Figure 2), the US imports from China reduced by 12.3% YoY. However, its imports from Vietnam were up 36.4% YoY, and from Taiwan up 22.5% YoY, from Bangladesh up 14.2% YoY, and from South Korea up 12.4% YoY. India too seems to be benefitting with 12% growth in exports; however, withdrawal of GSP benefits may curtail its growth in the coming months.

India has a chance to rise and shine with the ASEAN.

The trade war is already beginning to impact the Chinese economy and has forced the Chinese government to expedite structural reforms. Interestingly, somebody’s loss is also someone else’s gain.

In reality, several competing nations might emerge as potential winners in the short, medium and long run. Governments, manufacturers, traders, buying houses, retailers all are reacting to the challenges and opportunities arising from the present situation, particularly in East Asia, South East Asia and some African countries like Ghana, Ethiopia, and Nigeria.

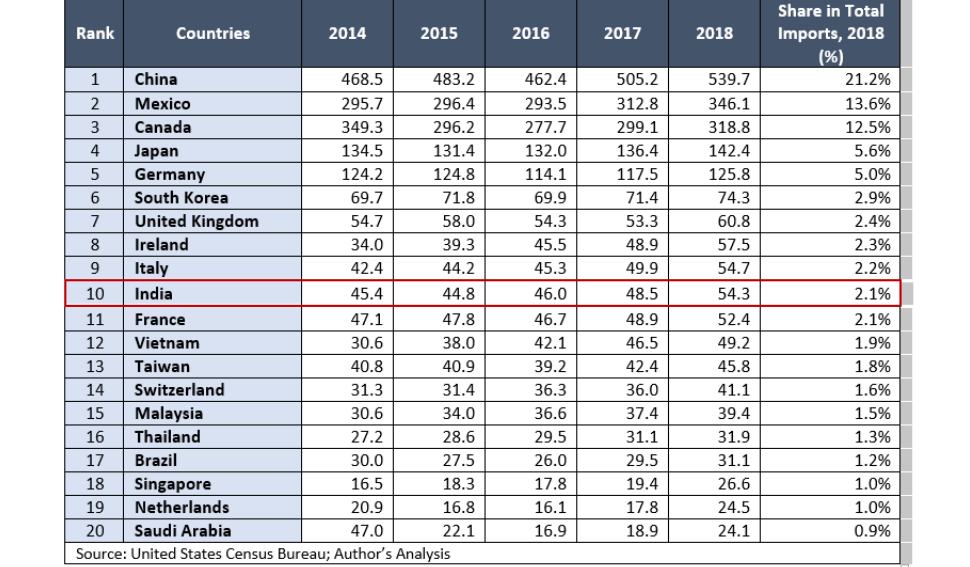

An interesting question can however be formulated: what’s in it for India, and how we can leverage this opportunity to increase our exports and build a strong manufacturing base for affected sectors? As the following graphs suggest, India has been the 10th importing country between 2014 and 2018 – with around two percent of the US’s market share. Yet over the first half of 2019, the market shares have increased by 12% when that of China decreased by an equivalent amount. Said differently, India is becoming a player which counts.

Figure I: United States — Top 20 Importing Countries, 2014–18 (in US$ billion)

Figure 2: United States — Top Importing Countries, Monthly Data, Jan–May 2019 (in US$ billion)

ASEAN and India — Benefitting from Trade Diversion and Attracting Manufacturing FDI.

ASEAN is likely to emerge as the fastest-growing trading partner for the US, as several countries in the region are likely to emerge as a substitute to China in the Global Value Chains. In addition, outward FDI from China as well as the relocation of factories of Japanese/South Korean/Taiwanese companies currently operating in China is also likely to gather momentum in the coming quarters.

There are two major insights to formulate here.

Figure 3: United States’ Imports from ASEAN Countries, Yearly Data, 2014–18 (US$ billion)

Figure 4: United States’ Imports from ASEAN Countries, Monthly Data, Jan–May 2019 (in US$ billion).

Insight #1: Vietnam has emerged as the biggest beneficiary of the US-China trade conflict.

The first insight here is that Vietnam has emerged as the biggest beneficiary of the US-China trade conflict as it latched on the opportunity of trade substitution in the short-run and is poised to gain from production relocation in the medium-term.

In the first five months of 2019, Vietnamese exports to the US have surged by 36.4% compared with the same period last year. With $25.8 billion in shipped goods until May 2019, Vietnam has become the eighth biggest source of American imports, up from 12th place a year ago.

As per the statistics released by the General Statistics Office of Vietnam, the country ran a trade surplus with the US (US$17 billion up to 5M19, +25.1% YoY), and a deficit with China (US$16.3 billion, + 48% YoY) and South Korea (US$12.2 billion, -3.6% YoY). This explains Vietnam’s newly acquired position as an assembler in the Global Value Chain with components and inputs being sourced from China and South Korea.

Vietnam’s top export growth to the US in the first five months of 2019 included Mobile Phone: 91.7% (US$3.77 billion), Electronics: 71.6% (US$1.78 billion) and Machinery: 54.6% (US$1.69 billion). Most of these products are those attracting the new 25% duty in the US when shipped from China.

Insight #2: Cambodia, Burma, and Laos have also benefitted from the retreat of Chinese imports to the US market.

The second insight is that besides Vietnam, Cambodia, Burma, and Laos have also benefitted from the retreat of Chinese imports to the US market. Likewise, Thailand and Malaysia on account of their existing ecosystem for electronics and automobile can attract relocating factories.

It is a known fact that Chinese companies have been heavily investing in these economies since last 4-5 years, and there is evidence of trade diversion from Mainland China to the neighboring ASEAN countries.

>> Read Also: Nicolas Michaux: Vietnam is becoming interesting for business.

However, before the onset of the trade war, these countries were attracting Chinese FDI due to rising wages, strict enforcement of environmental laws and the rising cost of production. Some of these macro factors have helped Vietnam make massive strides in the last 10 years for diversifying beyond shoes and apparel to relatively higher-value products by attracting companies such as Samsung, Intel and Canon.

For Vietnam in 1Q 2019, total and new registered FDI into manufacturing increased 66% and 33% YTD YoY, respectively. China, outpaced Vietnam’s other major investment partners, boosting investment 411% YoY. This partly reflects the trade diversion trend that was visible since the beginning of the year, and the trend is likely to continue over the near term – from both Chinese and non-Chinese firms. For example, LG announced in April that it would relocate its premium phone manufacturing to Hai Phong in 2H19, which accounts for 10-20% of LG’s smartphones.

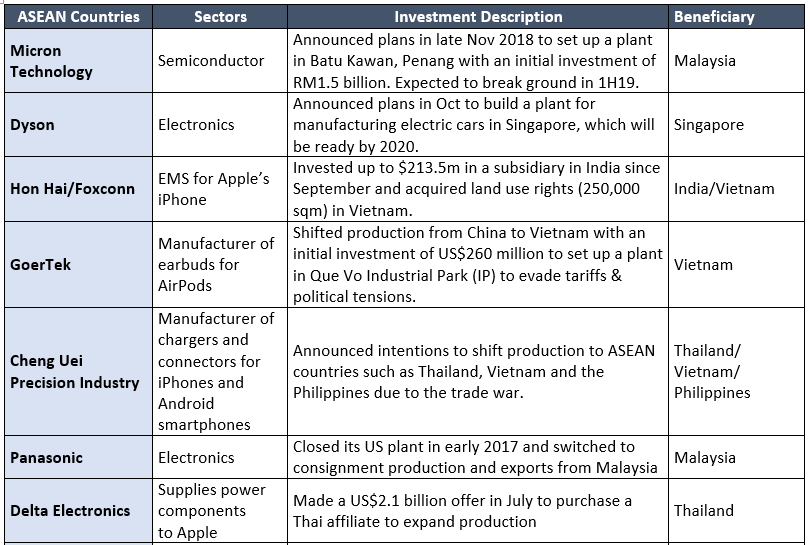

Some other examples of investment relocation and supply chain re-configuration favouring ASEAN economies are mentioned in Figure 5.

Figure 5: Investment Relocation and Supply Chain Re-Configuration.

ASEAN — No cheer without fears.

ASEAN’s cheer might be short-lived, however. The US has taken note of rising trade deficit with Vietnam and has suspected transshipment of Chinese goods with “Made in Vietnam” label to its shores.

This is forcing Vietnam to get stricter in dealing with such trade evasions. Hence the country will eventually get selective about the nature of FDI it wants to attract. Vietnam, being an export-dependent economy, will not want to position itself as a new hub for trade diversion for the US consignments.

ASEAN countries that are being captured by the US’ broadening trade war net include Vietnam (currency manipulation, undervaluation); Singapore (currency manipulation, undervaluation); Thailand (currency undervaluation, Generalized System of Preferences – GSP); Malaysia (currency manipulation); Indonesia (GSP); Philippines (GSP); Cambodia (GSP); and Myanmar (GSP).

The US has also accused several ASEAN countries of undervaluing their currency to manipulate the prices of their goods and has threatened to impose duties.

Five of the ten ASEAN countries are among the top twenty beneficiaries of the Generalized System of Preferences (GSP) privileges. In fact, Thailand (US$4.3 billion) and Indonesia (US$2.1 billion) are the 2nd and 4th largest beneficiary of this scheme.

Most of the ASEAN nations are much smaller in size and availability of labor pools than India, and very soon the available resources to attract new factories will be under stress. India should therefore capitalize on this opportunity by positioning itself as a long term and sustainable production hub.

India could build strategies for targeting opportunities rrising from the US-China Trade War.

India has gained marginally on the trade side due to the US-China trade war so far; however, it is yet to touch its true potential on attracting factories relocating from China or on integrating its manufacturers into the supply chain change process. Here are some of the steps that could help achieve these goals in the short to medium term.

1. India could customize strategies by Product/Industry Type

- Strategies to attract manufacturers for Apparels, Footwear and Toys.

- Over 35 US retailers for apparel & footwear and discount store operators have been working to diversify their sourcing options beyond China. Export Promotion Councils should work with these retailers, buying agents and other influencers to bring these orders to Indian factories.

- In-depth advisory on identifying credible suppliers and last-mile support in developing new vendors will help in building large order books for India.

- India should also focus on promoting Domestic Champions in these sectors and incentivize them to achieve compliance standards to meet the sourcing norms.

- Pushing for special indirect and direct tax-related incentive packages for investors in advanced technology sectors through a competitive bidding system. Priority sectors should include Semi-conductor Fabrication (FAB), Solar Photo Voltaic cells, Lithium storage batteries, Solar electric charging infrastructure, Computer Servers, Laptops, etc.

- Consumer electronics, another one-third of US imports from China, will take more time to move because the supply chain is rooted in China. India should start with attracting front-end assembly over the next three to five years.

2. India could push for Greater Market Access in Key Markets and Product Categories.

- India should negotiate hard with China to open its domestic market for Indian exporters in sectors like Pharmaceuticals, Agri-commodities, Organic Chemicals, Sea Food, Engineering products, etc.

- India should consider substituting Chinese imports to the US where India has a comparative advantage over China and its Southeast Asian counterparts: the Ministry of Commerce & Industry has already identified 350 products where India can emerge as a substitute sourcing location to China such as Rubber, Graphite Electrode, Organic Chemicals, etc.

3. India could turn the “Made in India for the World” label as a Development Theme for New Industries.

- About 300 factories making electronics goods such as smartphones and components, LED and TVs have started to run their operations in India. However, the majority of them are located at Noida-Greater Noida-Gurgaon-Manesar stretch which is approximately 1500 kms away from a major seaport.

- Efforts should therefore be made to locate them in zones that are cost-competitive from an export point of view. Prescribed steps could consist in establishing country-specific industrial parks in PPP mode in coastal states, in incentivizing industrial real estate innovations like Factory on Rent or Built to Suit in coastal states, in finding synergies between national programs like Skill India or Sagarmala to meet the industry’s requirement.

- Similar efforts should be made for attracting investments in Lithium-Ion batteries, Electric Vehicles, robotics, and other advanced sectors. As of now, our domestic demand is not sufficient to attract large scale factories.

4. India could strive to make Domestic Champions, wherever possible.

- India should avoid letting foreign-owned companies tap opportunities in the global trade, by promoting itslef as a base for last-leg assembly. The US-Japan trade war in the 1960-80s resulted in Japan pushing its assembly operations to South East Asia and then to China. Japan continued to run large trade surpluses against the US indirectly through exports of materials to assembly countries. Similar patterns are now visible in China to Vietnam to US trade flows.

- Domestic champions holding new positions in Global Value Chains (GVCs) can help India retain its competitive advantage in times of disruptions. Strategies could include incentivizing such endeavors by offering low-cost capital/tax incentives to Indian businesses willing to diversify into strategic sectors/industries. India might also encourage foreign/Indian OEMs to develop Tier 1 or Tier 2 Indian-owned suppliers by aligning production subsidies to support local vendors.

5. India might offer specialized Incentives to Attract Relocating Factories.

- Strategies could aim at reducing or waiving import duties on new or used machinery (with residual life of 5 years and above) or offer Additional Capital Subsidy on purchasing Made in India Capital goods

- Corporate Income Tax benefits could be considered to attract new factories and develop new industrial zones, especially those well-positioned for exports. E.g. Vietnam reduces corporate income in disadvantaged areas.

- Offering real Plug-n-Play facilities like Shovel-ready land parcels for factory construction, or Ready Built Sheds in good locations or Pre-approved Projects.

- Working on stabilizing production by understanding the key challenges of those industries such as availability of skilled workforce, labour productivity, access to reliable power supply network, water resources or cheaper fuels such as natural gas.

Divay Pranav | India-China Economic Relations Expert.

Divay Pranav is a Senior Associate Vice-President at Invest India, an entity under DIPP, Ministry of Commerce & Industry responsible for attracting and facilitating investments in India. Invest India is managing national missions such as Make in India and Start-up India.

At Invest India, Divay heads the China desk and is responsible for facilitating entry for Chinese companies in the Indian market. So far, he has worked with over 120 companies looking to invest FDI worth US$35 billion in India over the next 5 years and has successfully facilitated some of the biggest FDI deals from China and the Middle East over the last 3 years.

– Read more insights by Divay Pranav –

Disclaimer: The views expressed are those of their author(s) only and do not reflect those of The Asia-Pacific Circle or of its editors unless otherwise stated.

More food for thought?

Asia-Pacific Insights?

Are you looking for a big picture approach to APAC developments? From Financial Markets to trade diplomacy and geopolitics, The Asia-Pacific Circle connects the APAC dots in good business intelligence. [ Read all our APAC Insights ].

APAC Business Insights

APAC Business Insights

Looking for hints and tips about business trends? Our Asia-Pacific Business Insights closely look at Business developments in the APAC region. From regional investments to blockchain developments and China’s digital economy, our expert contributors connect the dots. [Read our Asia-Pacific Business Insights].

Financial Market Insights

Financial Market Insights

Financial Markets are predominant nowadays, hence our Asia-Pacific Insights closely look at financial developments in the APAC region. From financial regulation to Fintech policy and cryptocurrencies, the Circle’s Financial Market Insights connect the dots. [Read our Asia-Pacific Financial Markets Insights].

Trade Insights

Trade Insights

Pro-business policies or interventionism? Free trade or protectionism? What is the impact of China-US relations on global and APAC trade and business? Our APAC Trade Diplomacy insights also connect the dots! [Read our Asia-Pacific Trade Insights].

The Asia-Pacific Insights published on The Asia-Pacific Circle are copyrighted content and cannot be republished without the approbation of their author(s).